Private Equity or M&A: Advance Your Financial Strategy With Imperial Online Finance Courses

Synopsis:This blog explains how three Imperial College London finance courses—VC & PE, M&A, and the Emerging CFO Programme—help C-suite leaders choose the right path for their financial strategies. Explore deal structuring, investment evaluation, and leadership development aligned with your career goals. |

In today’s AI and technology-driven dynamic business environment, CFOs and senior finance executives must evolve beyond traditional roles. Whether it’s assessing business models, leading an M&A transaction, or restructuring a portfolio organization, finance leaders and modern CFOs are expected to demonstrate strategic financial leadership and robust financial acumen.

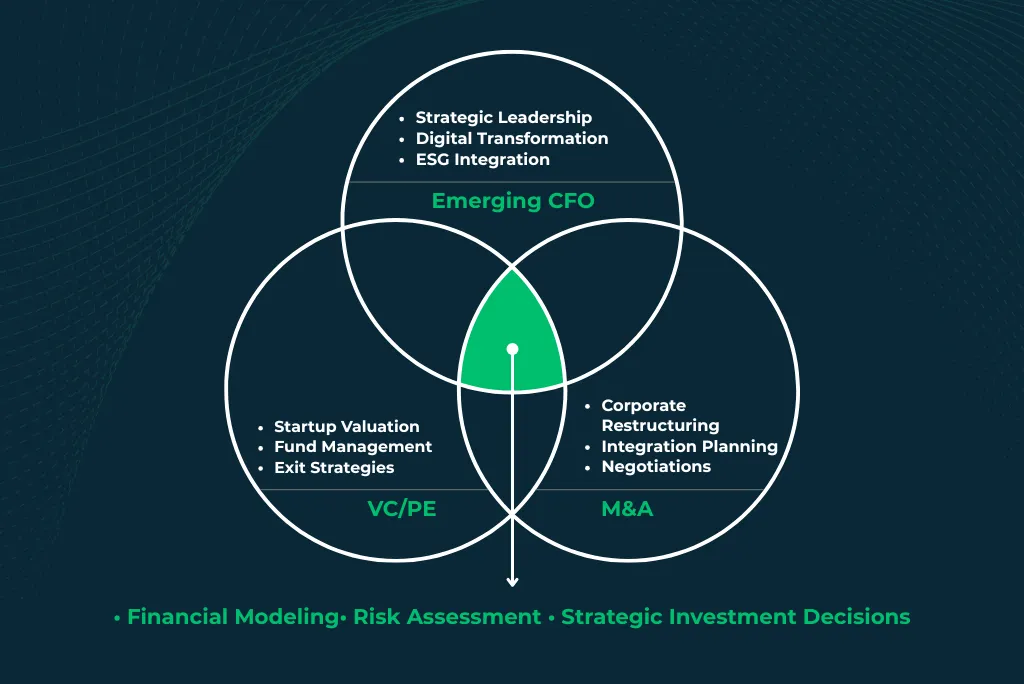

For those charting a career path through venture capital, private equity, or aiming for broader C-suite responsibilities, choosing from the right online finance courses becomes a pivotal decision. Imperial College Business School offers three specialized finance courses online under its Executive Education portfolio:

- Venture Capital and Private Equity: Investment Strategies

- Mergers & Acquisitions

- Imperial Emerging CFO Programme

This guide showcases the core strengths of these programs to help you set an executive education trajectory for your long-term financial leadership journey.

Deal Structuring: Tactical Execution or Strategic Direction?

The three Imperial College online finance courses comprehensively cover deal structuring—a vital aspect of the venture capital and merger and acquisition ecosystems.

- VC/PE Program: Designed to suit professionals in venture capital firms, private equity firms, or investment banking, this finance leadership development program covers term sheets, purchase price negotiation, and ownership models. The module “Deal Structure, Terms and Negotiations” empowers participants to manage the complexities of deal-making, from fund set up to due diligence and exit planning. You will explore how private equity investor’s structure deals with limited partners, pension funds, and insurance companies in mind.

- M&A Program: This finance leadership development program dives deep into the M&A transaction process—from structuring and negotiating to integrating the target organization with the acquiring organization. You will evaluate how to manage customer base alignment, assess intellectual property, and establish the right valuation models during transactions. The program is ideal for professionals looking to lead or support merger and acquisition efforts for a private company or publicly listed firm.

- Emerging CFO Programme: For mid-level professionals aiming for holistic learning, this finance leadership development program includes merger and acquisition strategies within a broader financial transformation lens. It is ideal for C-suite aspirants wanting to evaluate M&A alongside capital strategy, risk management, and ESG alignment.

Also read: Who Should Enroll in the Imperial Emerging CFO Programme: A Guide for Aspiring Financial Leaders

Investment Evaluation: Niche vs. Enterprise

The three Imperial College online finance courses cover various aspects of investment evaluation, as understanding it is essential for finance leaders:

- Venture Capital and Private Equity: Focused on evaluating venture opportunities and managing private equity portfolios, this Imperial College London course explores startup valuation, portfolio monitoring, and strategic fund management.

- Mergers & Acquisitions: The Mergers & Acquisitions program emphasizes evaluating organizational compatibility, due diligence, and integration planning. It includes modules on valuation, financial modeling, and strategic motives for acquisitions—skills crucial for finance professionals at private equity firms, consultancy, or corporate finance roles.

- Emerging Chief Financial Officer Programme: This emerging CFO course equips executives with a wide range of skills to make high-level investment and financial decisions aligned with corporate goals. This finance leadership development program emphasizes data-driven insights, stakeholder communication, and capital allocation.

Exit Strategies and Post-Merger Integration: Planning for Continuity

Success in both venture capital and merger and acquisition depends on what happens after the deal closes. To ensure smooth business continuity post-merger, the three Imperial College online finance courses emphasize various aspects of exit strategies and post-merger integration.

- Venture Capital and Private Equity Program: A strong focus on exit strategies prepares participants to manage portfolio company transitions through IPOs, strategic exits, or secondary sales. Real-world case studies highlight successful and failed exits.

- Mergers & Acquisitions Program: This online finance course emphasizes post-merger integration (PMI), exploring value drivers, cost synergies, and human capital considerations. Understanding business model alignment and technology integration is crucial.

- Emerging CFO Programme: This finance leadership development program positions M&A and exit decisions within a broader transformational lens, focusing on financial planning, restructuring, and corporate finance with ESG strategy.

Selecting the Right Program for Your Finance Leadership

For CFOs and senior finance executives transitioning to the C-suite, choosing the right specialization is more than an educational decision—it’s a strategic investment in your leadership advancement. Whether you are managing portfolios or guiding a small business through acquisition, the Imperial College online finance courses offer targeted knowledge and tools tailored to real-world challenges.

With Imperial Executive Education, you access business school executive education that brings together cutting-edge content, global faculty, and transformative learning experiences designed to shape the finance leaders of tomorrow.