Preparing Your Workforce for the Future of Fintech

Banking has existed in some form for millennia. And for many centuries, the core principles and activities of the financial industry essentially remained the same, even as the scale of global financial activities grew exponentially.

In recent years, however, the advent of new financial technologies (colloquially known as fintech) has fundamentally changed the way consumers and businesses alike interact with finance and related industries.

For companies and leaders, this shift has opened up some big questions. What does the future of fintech hold for organizations inside and outside the financial services industry? And what can companies do now to prepare their workforces?

What Leaders Need to Know About the Future of Fintech

As a refresher, fintech broadly refers to the application of emerging technology to the financial services industry, generally to streamline and improve the delivery of core services. Today, fintech startups and legacy companies that embrace emerging technology are challenging existing financial services business models. How? By disrupting intermediaries, reducing fees, offering an improved customer experience, and democratizing financial services products.

Digital banking, cryptocurrencies, and “robo-advisor” investing firms are all examples of consumer-focused fintech innovations. But new technology is also transforming back-office operations.

The promise of fintech has made it the leading sector for venture investment in recent years—even amid the challenging financial landscape of 2022. But fintech isn’t just for startups. It’s relevant to companies of all sizes in banking, investing, real estate, insurance, risk management, regulation, and other fields in the financial industry.

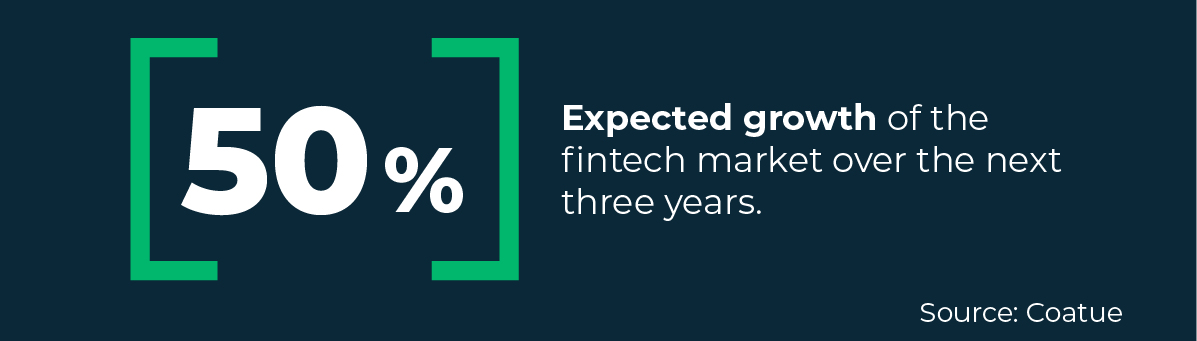

The venture firm Coatue predicts the fintech market cap will grow by 50% in the next three years, with nearly unlimited potential for companies that can tap into this market while maintaining sound business practices. Legacy companies that don’t adapt, on the other hand, face a serious risk of disruption. To stay ahead in this fast-changing landscape, corporations and their employees need to develop the new skills and capabilities required to adapt to—and innovate—new financial technologies.

Fintech Focus Areas in 2023

Fintech innovation is wide-ranging and fast-moving. However, current technological advances and investments can be broadly grouped into four key areas. According to University of California, Berkeley Executive Education, leaders and managers across financial services and related industries should be aware of these categories of innovation, the opportunities they may offer, and their potential for disrupting existing businesses.

- Microfinancing and crowdfunding: Providing financial services to those who have traditionally lacked access to tools such as banking and lending.

- Payments and remittances: Offering new tools for making payments and transferring money, including across currencies, with increased speed and decreased costs.

- Cryptocurrencies, blockchain, and other distributed ledger technologies: Creating decentralized, highly secure platforms for storing data and conducting transactions and offering alternatives to traditional fiat currencies.

- Robo-accounting/advising, algorithmic trading, and high-frequency trading: Using advanced mathematical and analytical tools to streamline and optimize investing.

Fintech startups have emerged in each of these areas to challenge legacy companies with new products and services that address unmet needs in both the B2B and consumer spaces.

Top Capabilities Needed for Fintech Success

To make the most of the opportunities the fintech revolution offers, major corporations and scrappy startups alike need teams equipped with not only broad industry knowledge but also emerging technical skills.

The top three capabilities companies need to develop to prepare for the future of fintech are:

1. Artificial Intelligence and Machine Learning

As you likely know, artificial intelligence and machine learning use advanced computer systems to simulate human intelligence, make decisions, and learn from prior inputs, offering companies the ability to scale services and perform tasks that aren’t feasible with human labor alone. Applications of AI and ML in fintech include:

- Fraud detection and prevention

- Regulatory compliance

- Credit risk assessment

- Institutional trading

- Consumer investment advising

- Customer service

To take advantage of these opportunities, companies need employees with the technical skills to build out and optimize AI and ML applications. They must also develop company-wide familiarity and comfort with these tools and their capabilities to ensure effective teamwork and innovation.

2. Data Analytics

Today, major banks and small fintech startups alike gather and store vast quantities of consumer and operational data. Increasingly, companies need data scientists and analysts to manage and use this data to drive decision-making and optimize performance. Applications of data analytics in fintech include:

- Marketing

- Customer service

- Product development and refinement

- Risk management

- Investment decision-making

- Regulatory compliance

Data analysts in the fintech industry need a strong grounding in core data science principles to succeed, as well as specific knowledge of the specific challenges and opportunities that high-frequency fintech data presents.

3. Blockchain and Distributed Ledger Technology

Despite recent setbacks in the cryptocurrency space, blockchain and distributed ledger technology remain one of the most promising areas of financial innovation. The top use cases for blockchain in financial services include:

- Smart contracts

- Fraud prevention

- Decentralized payments

- Tokenization of assets

- Cryptocurrencies

To make smart investments in this space, companies need teams that understand the complexities of blockchain systems and can evaluate their application to various financial products and services. They also need to understand the complex risks associated with decentralized finance.

In addition to these core capabilities, companies also need employees with knowledge and skills in a variety of related areas, including embedded finance, global fintech regulation, open banking, banking-as-a-service, strategic finance, and financial governance.

How to Build Teams for the Future of Fintech

Globally, fintech talent is in short supply. Companies face increasing challenges in recruiting and retaining qualified employees for key roles—and even highly-qualified talent may lack important context and knowledge specific to the intersection of finance and technology.

Berkeley Fintech: Frameworks, Applications, and Strategies, a University of California, Berkeley Executive Education course delivered in partnership with Emeritus, prepares teams to make the most of opportunities in the fintech space—and to meet emerging challenges head-on.

This course, designed for teams in banking, investing, real estate, insurance, risk management, regulation, and other fields in the financial industry, as well as fintech startups, dives deep into both the financial and technological considerations to offer a holistic view of the future of fintech.

This two-month online course pairs theoretical knowledge with real-world applications and is structured around three primary outcomes.

Section One: Building Foundational Knowledge and Understanding ‘Why Now?’

The first section of the program provides teams with a comprehensive overview of the fintech revolution history to date, the broader fintech landscape and the economic foundations of fintech. It ensures teams have a shared understanding of the foundations of fintech and the overall opportunity, answering the question of “why now”?

Section Two: Developing Technical Knowledge

The program provides an in-depth overview of the skills and core capabilities that are driving the fintech revolution: AI/ML, data science, blockchain/distributed ledger technology, financial literacy, and a deep understanding of the ecosystem. Teams will learn the core principles of each area, understand how the technology is applied, and identify opportunities to use new tools to add value. Employees in both technical and non-technical roles will understand where the competition is headed and how to stay one step ahead.

Section Three: Real-World Application

The final section of the program applies fintech theory and principles to real-life business challenges. Using case studies from both startup disruptors like Venmo and legacy companies like Fidelity, participants explore applications of fintech business models and learn from notable Silicon Valley VCs and others (e.g., a World’s Private Equity leader) about what makes a great investment. Finally, the focus is on applying new frameworks to assess a fintech valuation as well as identify fintech ideas or investment opportunities for your organization.

As the future of fintech evolves, shared knowledge and language will be critical to teams’ and organizations’ success. Completing the Berkeley Fintech course as a team will build that shared framework and ensure you have the tools necessary to think about how your organization’s core capabilities can be leveraged as a strategic advantage—preparing you to succeed amidst ongoing change and disruption.

Learn more about group enrollment options in the Berkeley FinTech course to ensure your team is prepared for the future of fintech.