The Need for Data and AI Skills in the Insurance Industry

For years, futurists and academics have declared that artificial intelligence (AI) and data analytics would change the way we do just about everything.

Today, that prediction is coming true. Industries ranging from automotive manufacturing to healthcare are increasingly reliant on data and AI. And insurance is no exception. To remain competitive, insurers across all lines of business will need to embrace emerging technologies and analytics.

Why Data Analytics and AI Are Essential for Insurers

It’s been a rocky couple of years in insurance. In addition to the wide-ranging impacts of the COVID-19 pandemic, natural disasters such as major wildfires and hurricanes have wrought havoc on every sector of the industry, from life insurance to large commercial lines. In fact, McKinsey & Company reports that 2020 set a new annual record for catastrophic weather events (referring to those with at least $1 billion in damages).

These trends are unlikely to abate. Just as some risks have become more measurable and predictable, black swan events are increasingly common. To succeed in this environment, insurers need to refine their risk assessment and model the potential impacts of capital-intensive disasters.

Doing so will require not only typical actuarial models but also the use of data analytics in insurance. This means leveraging data sets ranging from weather models to personal health tracking—a task that requires specific expertise in data analytics and the application of AI in insurance. Further, insurers will need the expertise and records to effectively explain their methodology to regulators.

By highlighting potential areas of risk, making underwriting more effective, and reducing the human inputs required for basic tasks, insurance companies can trim their expenses, better position themselves to handle unexpected crises, and ensure they don’t fall behind their competitors. That’s where upskilling and reskilling, either from an organizational or individual perspective, come into play.

To remain competitive, insurers across all lines of business will need to embrace emerging technologies and analytics.

Applications of Data Analytics and AI in Insurance

According to McKinsey, 10 to 55% of the work performed by major functions within insurance companies—including actuarial, claims, underwriting, finance, and operations—could be automated over the next decade, while 10 to 70% of tasks will change significantly in scope. That means insurance professionals in all positions will need upskilling and reskilling to succeed.

Plus, as consumers grow accustomed to fast, responsive digital services available on-demand, they will expect the same from their insurance providers. Long waits for decisions and cumbersome paperwork simply won’t cut it anymore.

Data Analytics and AI for Actuaries

Actuarial science as traditionally practiced bears many similarities to data analytics. So, it’s no surprise that the rise of big data and AI have numerous implications for actuarial work. Actuaries’ work in assessing and advising on financial risk has long depended on applying financial and statistical theories and models. Success depends in part on the quality of data inputs.

Access to new types of data allows actuaries to fine-tune rate tables and risk predictions better than ever before. But the volume and speed of data inputs now available exceed that which can be parsed using traditional methods. Data sources might include information from product developers, reinsurers, distributors, and more.

That’s where data science in insurance comes in. Data analysis that relies on programming and statistical knowledge will allow actuaries to parse massive, rapidly-changing data sets to identify risk predictors. While human judgment remains essential, actuaries will need to have a baseline knowledge of data analysis that allows them to work with data scientists, especially if they are not doing the programming work themselves. Specifically, actuaries will need to understand the role of predictive analytics as opposed to traditional inferential statistical models.

For example, as the impacts of climate change continue to rock the insurance industry, data analysis that can parse complex weather and satellite inputs to predict potential damages will become more important. Since the full impacts of climate change are currently unknown, insurers will need to commit to the ongoing use of advanced data analytics models to stay on top of climate-related threats.

Emerging AI technologies add even more power to big data in insurance. Until now, “unstructured data”—such as social media posts, letters, voice recordings, and more—has required manual parsing, meaning its use has been primarily limited to assessing individual cases rather than predicting risk. However, the advent of machine learning and natural language processing have allowed actuaries to delve into this data on a much broader level. This is because the computers themselves can process information and adapt algorithms and analytics accordingly.

Data Science and AI for Underwriters

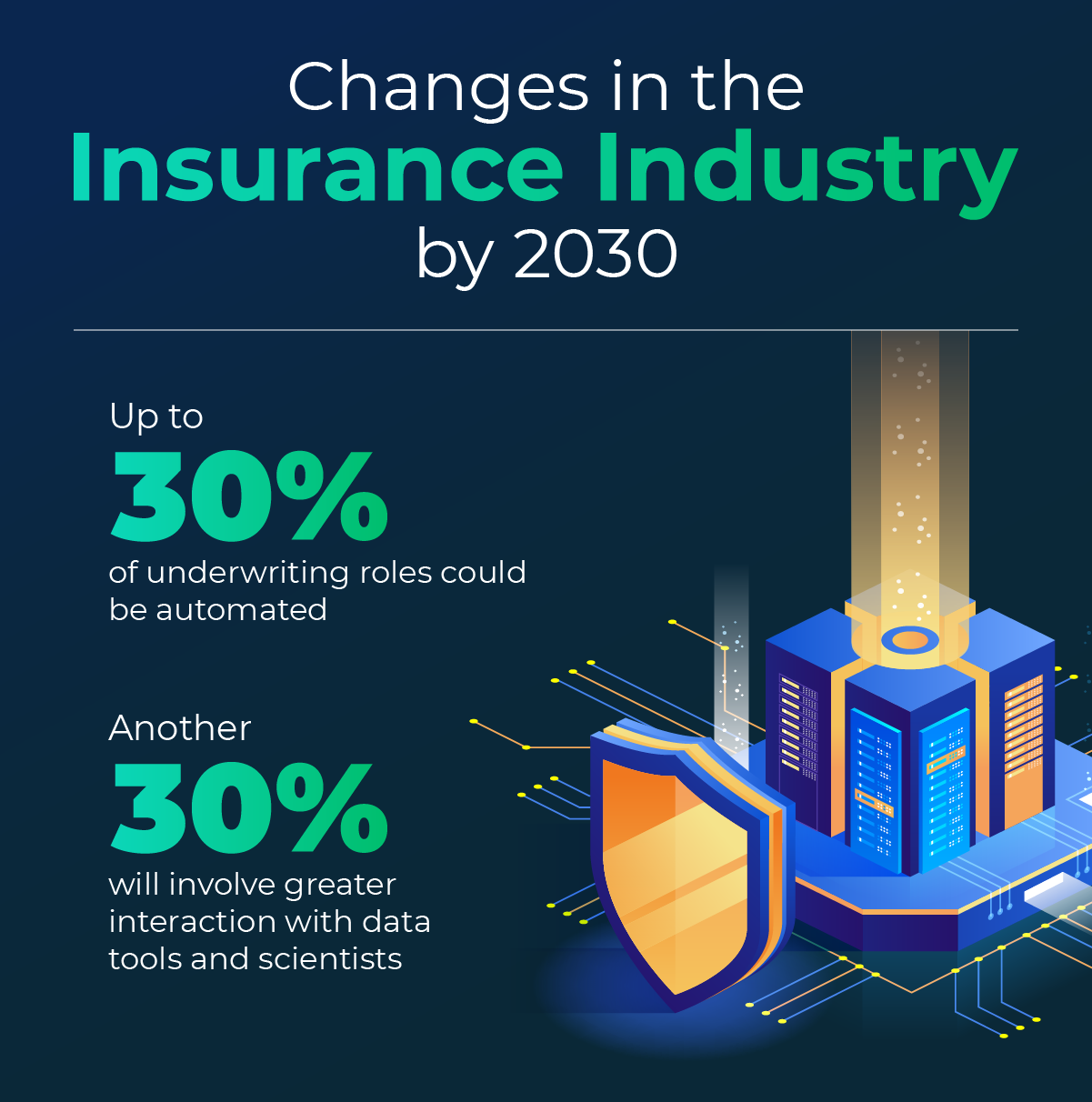

Like actuaries, the roles of underwriters will shift as insurance companies embrace data science and AI. McKinsey predicts that up to 30% of underwriting roles could be automated by 2030, while another 30% will involve greater use of analytics tools and cooperation with data scientists. This makes the upskilling of underwriters an imperative.

And just as data science and AI will enable more accurate risk prediction at scale, underwriters can leverage these skills to better predict risk and write policies on an individual level—allowing them to remain competitive on pricing without taking on undue risk.

This shift is already apparent in the auto insurance industry. The combination of personal driving histories and telemetric data from cars (everything from the miles driven to the car’s location) can allow insurers to use AI to create precise quotes and offer rate adjustments based on ongoing information flows. Thanks to big data and algorithms, insurers can provide instant quotes to customers with lower risk profiles, allowing underwriters to focus on more nuanced cases.

Life insurance is another area ripe for disruption. Underwriters will continue integrating new data sources, ranging from prescription medication data to pet ownership to credit scores. With access to robust data analytics and AI in insurance, effective underwriting will require fewer invasive requirements and more straightforward applications.

Outside of insurance companies themselves, tech startups are offering insurers everything from machine vision assessments of homes to risk assessments based on a wide variety of information sources.

Data Science and AI in Insurance Sales

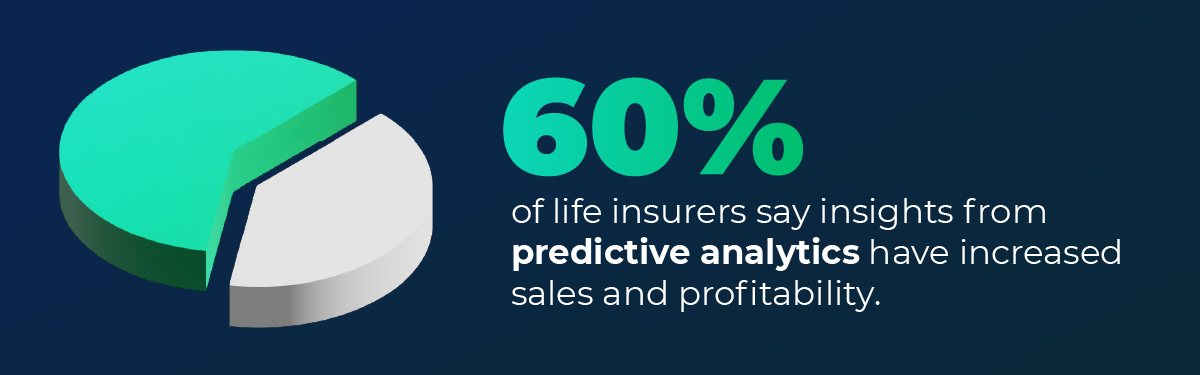

Data analytics, particularly predictive analytics, also have major implications for the marketing and sales of insurance policies. A recent Willis Towers Watson study found that 60% of life insurers report that predictive analytics have increased sales and profitability. Perhaps this isn’t too surprising since this type of information allows companies to focus on the people most likely to follow through to a purchase.

In particular, data analytics can provide insight into “appetite alignment” with brokers, the primary distribution channel for most insurers. With massive treasure troves of data about everything from spending habits to social networks now available, companies can slice and dice that information to identify the segments of the market who are most likely to be interested in their products—and most likely to be profitable. Once they have built that understanding, they can then hone in on the exact messaging that works with different groups and more narrowly target their offerings based on those findings.

Of course, retaining customers long-term is just as important as selling plans in the first place. Data analytics can help insurers understand factors that may lead to a customer ending coverage so they can intervene early with personalized outreach or offers. Further, it can help identify existing customers who may be good targets for cross-selling and up-selling.

Finally, data analytics can also help parse new policies, renewed policies, or changed policies for signs of fraud, creating an opportunity to detect possible bad actors far earlier in the process than was historically possible by flagging inconsistent or suspect information as it is entered into an insurer’s databases.

Data Science and AI in Insurance Claims Processing

Claims processing is another area in which data analytics and AI for insurance can provide a significant advantage.

Claims processing has historically required significant person-power, much of it spent on fairly repetitive and rote tasks. PwC predicts that as data analytics and AI allow insurers to automate much of that work, the role of adjusters will shift to taking on more complex cases, providing manual reviews, and delivering exceptional customer service.

Already, many insurers allow customers to start the claims process via a chatbot, reducing the time and money spent on simple questions and information-gathering. Progressive even recently expanded its customer-facing AI to include voice-chatting capabilities for Flo, its digital assistant. They use natural-language processing to “converse” with customers—even sharing jokes upon request.

In terms of managing the claims themselves, advanced data analytics and machine learning are increasingly enabling automated decisions. Disruptive insurer Lemonade uses machine learning to compare claims against others in its database to detect potential fraud, a use case that is poised to grow significantly across the industry. While complex claims are referred to a human, simple claims can take as little as three seconds.

Insurers are also applying machine learning to damage assessment. The startup Tractable uses machine vision to help adjusters assess automobile damage and calculate an appropriate payout. McKinsey predicts this area will continue to grow, the rise of connected technology and new applications of AI in insurance making rapid claims resolutions possible.

Preparing for the Demands of the Future

As these changes and more impact the insurance industry, providers are facing the need to upskill their employees. PwC reports that 81% of insurers are concerned about the availability of key skills within their workforce—but that doesn’t necessarily point to a need for massive hiring.

As McKinsey points out, hiring a new employee costs 100% or more of their annual salary, while upskilling or reskilling typically costs 10% or less. And with a highly competitive talent market for data analysts, bolstering internal resources through training opportunities (such as those Emeritus provides) will be essential to success.

With expertise in data analytics and artificial intelligence, Emeritus’ Enterprise team can help you plan and execute a comprehensive upskilling program for your company. Contact us to start the conversation.

You can also explore our data analytics and artificial intelligence online programs for individual enrollment.